Convertible Bonds Advantages and Disadvantages

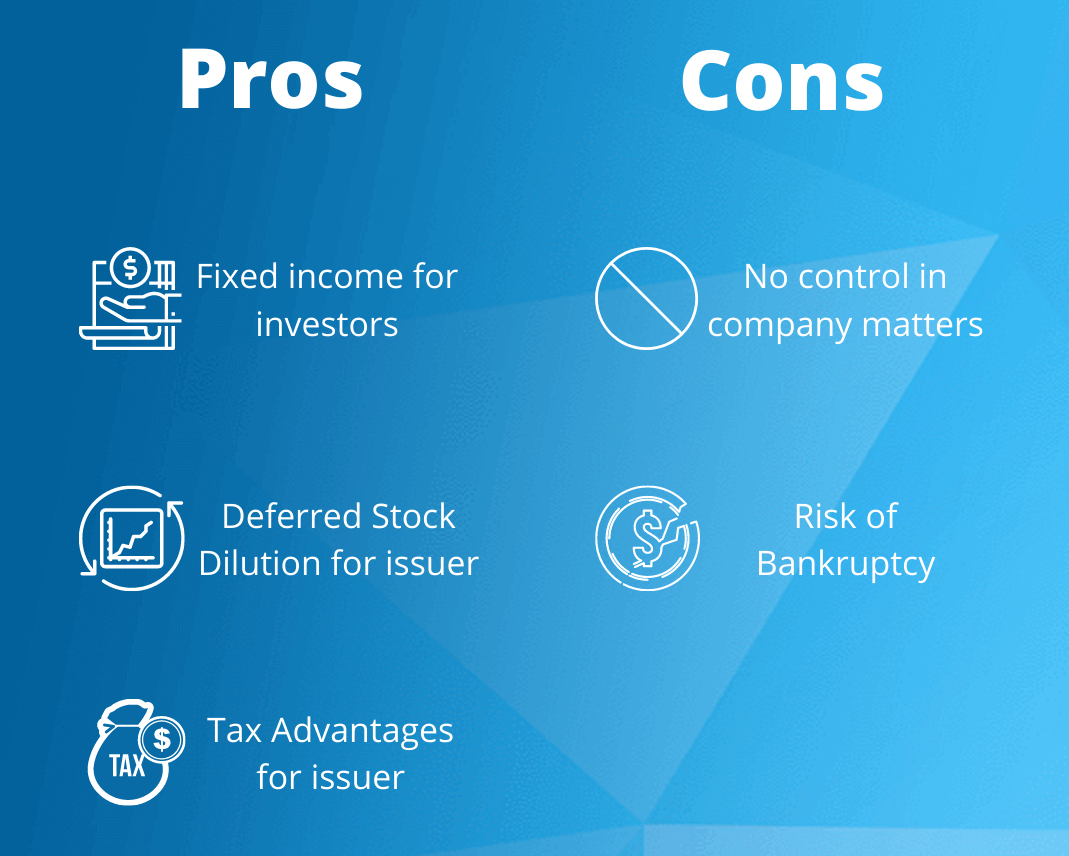

Needless to say that this list only comprises of the commonly listed pros and cons and should not be considered to. Advantages and Disadvantages Of Convertibles From the issuers perspective the key benefit of raising money by selling convertible bonds is a reduced cash interest payment.

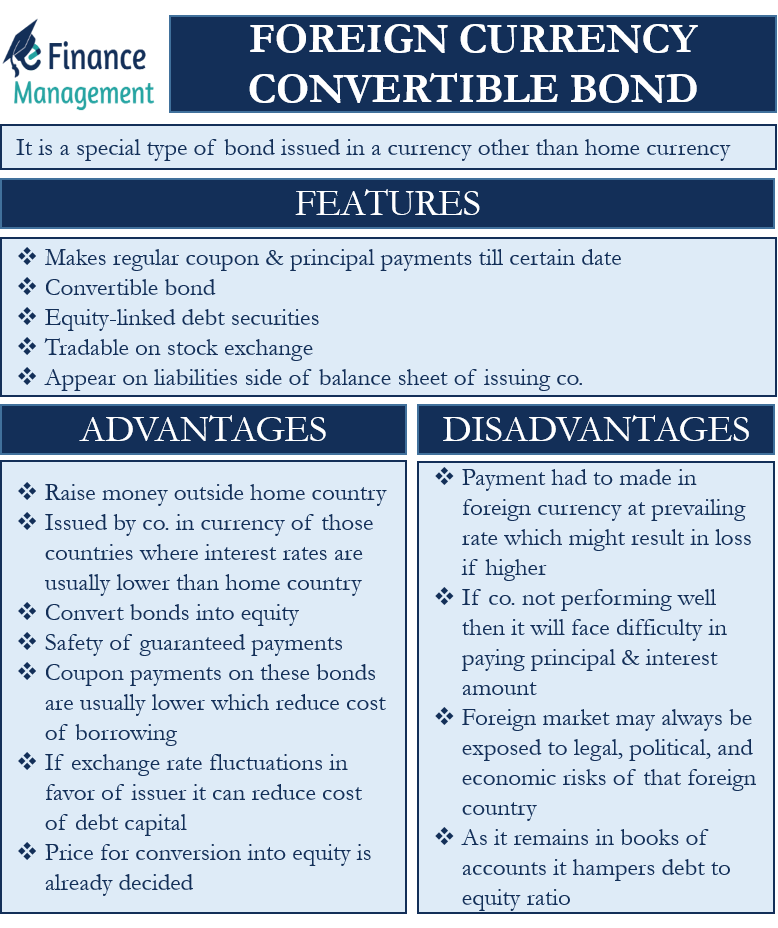

Foreign Currency Convertible Bond Fccb

The advantages and disadvantages have been mentioned in this article.

. Bullet bond is a. Because its usually cheaper and less time-consuming to issue convertible debt instead of stock youll get your money faster. No Loss of Control.

An ability to raise cash quickly in the early. Some of the benefits include. A The value retained for the shares subsequently converted Convertible bonds work like a traditional loan.

Bonds advantages and disadvantages is a subject that has been quite often researched. Disadvantages of foreign currency convertible bond More risk of volatility of the market as more than one economy come into picture. Read customer reviews find best sellers.

Other disadvantages mirror those of utilizing straight debt although convertible bonds do entail a greater risk of bankruptcy than preferred or common stocks and the. Search For Highest Rated Bond Funds at Discoverthebestco. Ad Find Highest Rated Bond Funds.

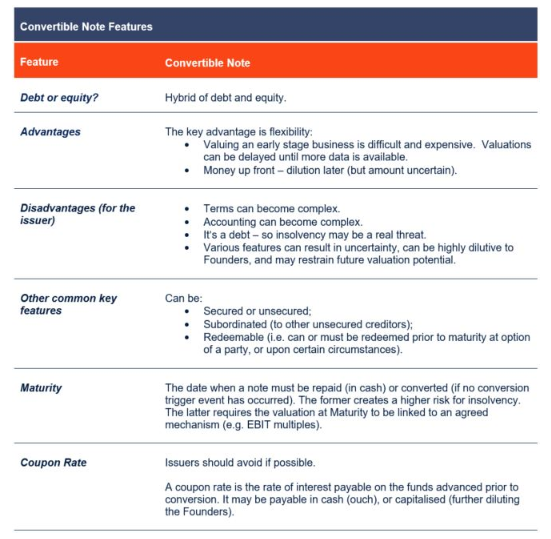

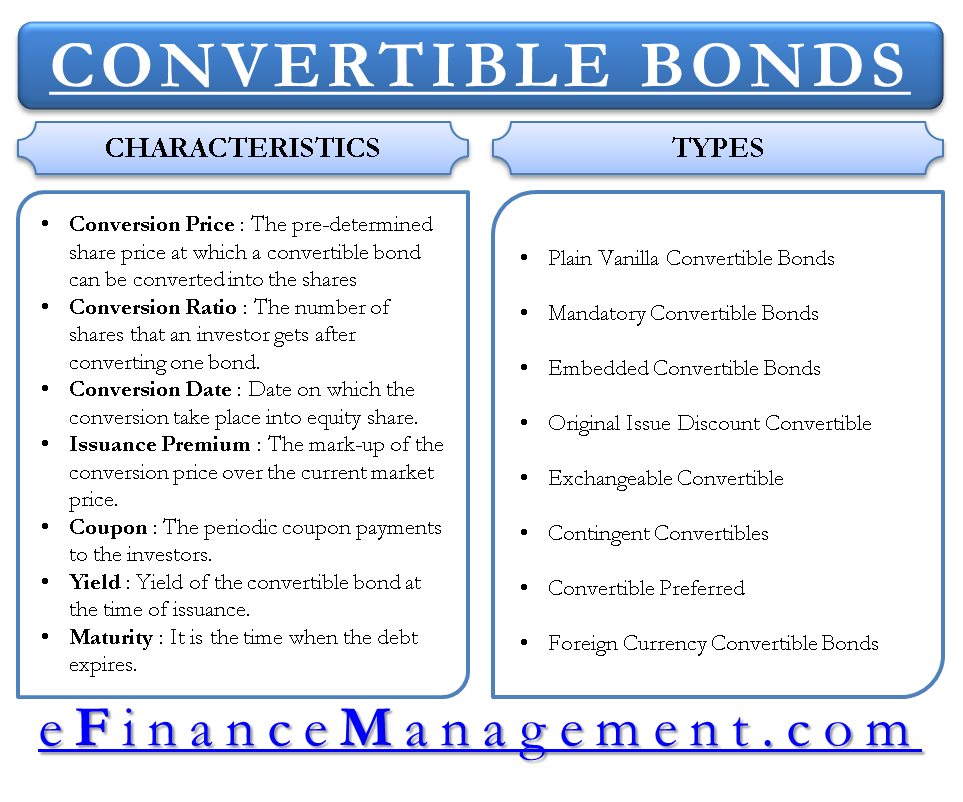

Convertibles may be attractive to particular investors. The amount of money that is borrowed by the company does not. We will evaluate following types of bonds and their positive and negative sides.

Interest rates on convertibles are usually lower than on straight bonds. There is a risk of exchange as the interest is to be paid. A convertible debenture is a bond that may be exchanged for stock at a particular point in time by the investor or the.

Browse discover thousands of brands. With convertible debt you dont have to worry. You may be surprised about what you read.

This is because these bonds are not widely held by a lot of. If you purchase convertible debt that automatically converts into stock. Retirees beware of this conventional wisdom.

A primary disadvantage of convertible bonds is their liquidity risk. Another advantage of convertible debt is that there is no loss of control as a result of issuing such a debt. Interest charges on bonds.

Convertible Bonds advantagesdisadvantages Lower Interest Rate - The benefit to the issuer of convertible bonds is that investors will accept a lower interest rate since there is potential. Ad Learn why conservative investing might not be as safe and prudent as it sounds. The Disadvantages of Convertible Debentures.

Firstly it needs to be understood that there is a very limited secondary market for reverse convertible bonds. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Convertible bonds are a flexible option for financing that offers some advantages over regular debt or equity financing.

Thus the company is required to pay interest to its creditor.

Convertible Bond Everything You Need To Know Eqvista

The Pros And Cons Of Convertible Notes And Are Safe Notes Really Safe Lexology

No comments for "Convertible Bonds Advantages and Disadvantages"

Post a Comment